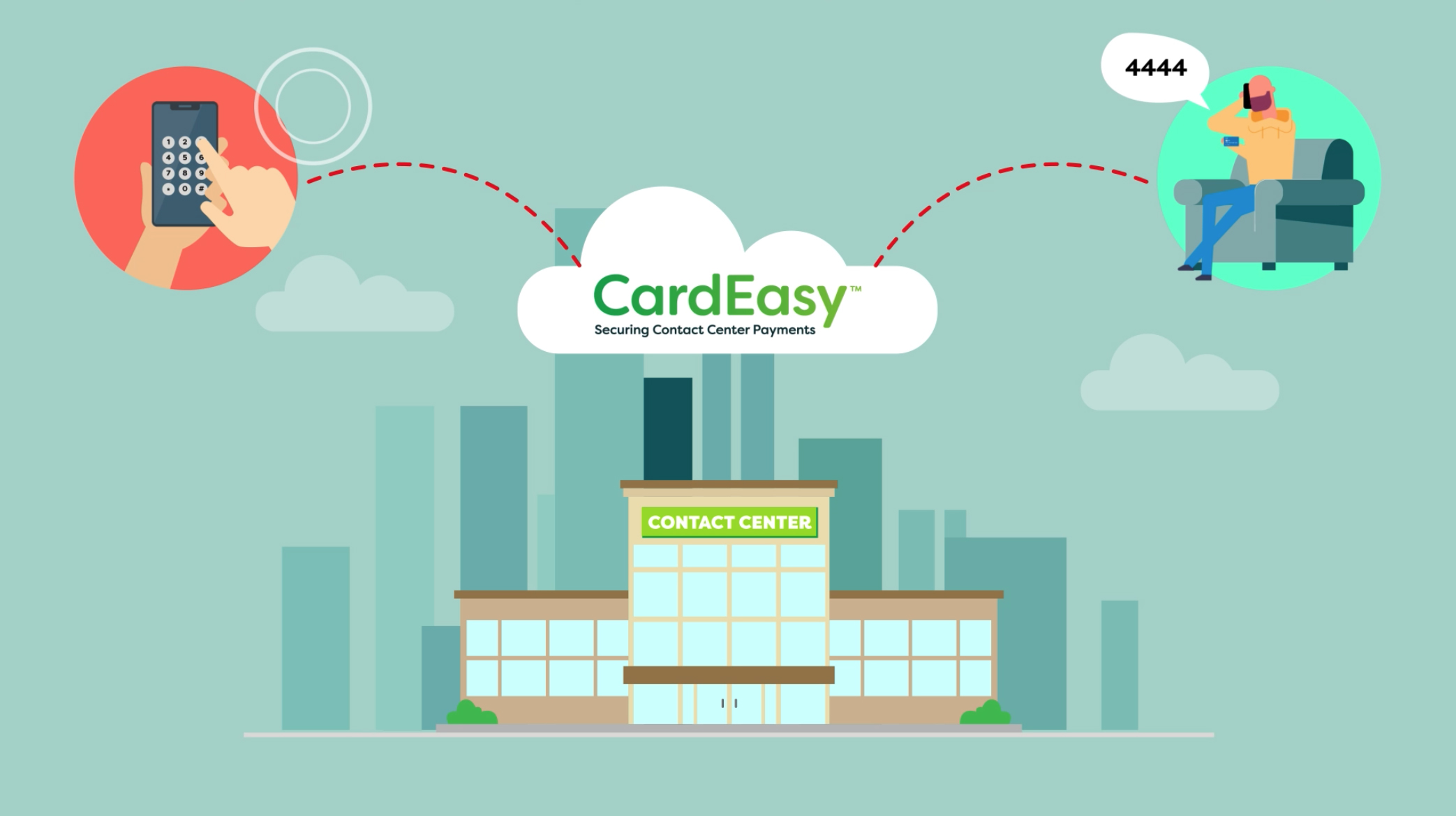

CardEasy provides a secure, PCI DSS compliant payment solution for contact centers for both voice and digital channels

Whether your customers choose to pay over the telephone or via a digital channel such as Email or Webchat, CardEasy provides a simple, secure, and cost-effective payment solution that will protect your customers and de-scope your contact center environment from PCI DSS.

Seamless integration with your existing telephony and IT infrastructure reduces risk and costs

As well as being simple and user-friendly, CardEasy is affordable, available worldwide and is suitable for any merchant operating a contact center. We work closely with our clients to ensure the safeguarding of their customers’ data, meet mandatory compliance requirements and help them exceed their customers’ expectations in terms of data security.

-

SofologyThe level of engagement we’ve had from the CardEasy team has been great. The selling points of CardEasy are obviously that it has an attractive price point and its ease of use, but the biggest selling point, certainly from my perspective as the IT service delivery manager, is the level of service that we get from the CardEasy team. For me, that’s worth its weight in gold.

SofologyThe level of engagement we’ve had from the CardEasy team has been great. The selling points of CardEasy are obviously that it has an attractive price point and its ease of use, but the biggest selling point, certainly from my perspective as the IT service delivery manager, is the level of service that we get from the CardEasy team. For me, that’s worth its weight in gold. -

HiscoxOverall we’re very happy with CardEasy. We need systems that support our high quality customer service ethos and meet our commercial requirements and in our case, CardEasy matches those needs and does exactly what it promised.

-

Allied Irish BankThe CardEasy solution easily de-scopes us from PCI DSS compliance and mitigates the risk of any internal fraud. The platform is scalable and easy to use…along with the confidence we have in Syntec who have been instrumental in a smooth implementation, guiding us and offering insight.

Allied Irish BankThe CardEasy solution easily de-scopes us from PCI DSS compliance and mitigates the risk of any internal fraud. The platform is scalable and easy to use…along with the confidence we have in Syntec who have been instrumental in a smooth implementation, guiding us and offering insight. -

MicronWe have been impressed by the flexibility, ease of integration and support of the CardEasy system, as well as its PCI DSS security to protect in-house operations and our outsourced service providers in the USA and EMEA.

-

Charles TyrwhittWe wanted to further enhance data security in our call centre and decided to use Syntec’s secure phone keypad payment (DTMF), as it’s important to our customers that our payment solution is safe and easy to use. CardEasy works just as effectively for callers in the USA, Germany and Australia as in the UK.

Charles TyrwhittWe wanted to further enhance data security in our call centre and decided to use Syntec’s secure phone keypad payment (DTMF), as it’s important to our customers that our payment solution is safe and easy to use. CardEasy works just as effectively for callers in the USA, Germany and Australia as in the UK. -

StaplesCardEasy ‘keypad payment by phone’ was the perfect fit to resolve the PCI compliance and data security needs in Staples’ major call centres in Europe. This was because of its ease of use mid-call, the breadth of PCI DSS issues it resolves in one go, the flexibility of integration with all our differing systems and the ability for them to meet our tokenisation requirements.

-

LocusWe chose Syntec because they had the solution that we needed to de-scope our live contact centre agent and IVR environment. Syntec was the only vendor that provided the flexibility to integrate with our home-grown systems because their system can be cloud-based, with no requirement to change any of our existing IT.

LocusWe chose Syntec because they had the solution that we needed to de-scope our live contact centre agent and IVR environment. Syntec was the only vendor that provided the flexibility to integrate with our home-grown systems because their system can be cloud-based, with no requirement to change any of our existing IT. -

HurtigrutenThe professionalism with which Syntec approached everything was second to none and they assisted us and bent over backwards to ensure we were PCI compliant. They are always quick in their approach and have assisted us in areas where they did not even have to, which is a testament to their professionalism. CardEasy itself is simple and easy to use and takes away the risk for our customers knowing their card details are secure.

HurtigrutenThe professionalism with which Syntec approached everything was second to none and they assisted us and bent over backwards to ensure we were PCI compliant. They are always quick in their approach and have assisted us in areas where they did not even have to, which is a testament to their professionalism. CardEasy itself is simple and easy to use and takes away the risk for our customers knowing their card details are secure. -

MieleMiele selected Syntec’s pioneering, hosted CardEasy system to enrich customer service whilst de-scoping us from large sections of PCI DSS regulations, which otherwise require significant cost and effort to satisfy.

-

AvonOne of the good things about CardEasy is that it is payment processor or acquirer agnostic so you have one solution that fits all of your customers. Generally, the amount of effort that Syntec has had to put it in from an integration perspective has been very little, which has been really good. Confidence levels are high. Everything is good.

AvonOne of the good things about CardEasy is that it is payment processor or acquirer agnostic so you have one solution that fits all of your customers. Generally, the amount of effort that Syntec has had to put it in from an integration perspective has been very little, which has been really good. Confidence levels are high. Everything is good.